Seamless Distribution Systems (SDS) is a global technology leader in delivering end-to-end software platforms for electronic transactions and digitalization of the supply chain of Mobile Network Operator's services, as well as fintech solutions. SDS consistently delivers process efficiency and operational excellence, with 30+ years of experience and closeness to customers.

Revenue growth: the company targets a compound annual growth rate (CAGR) of ca 6-11% over the years 2025 to 2027 (excluding SDD which already has a minimal revenue contribution and is being discontinued). The company sees great opportunities to expands sales of its existing products and solutions with the existing customer base, just like the company has recently done in both Bangladesh and Oman. In addition, Seamless aims to expand with a few new customers and markets per year, including a beachhead in Latin America. Each new product and solution implementation will provide additional recurring revenue. Recurring revenue will grow mid to high single digits annually and will continue to account for at least 60% of the annual revenue base. The plan is built on an assumption of securing new orders slightly above 8 MUSD in 2024 for project-based sales (products and solutions), where the company has already achieved 6 MUSD at the date of release and is targeting 9 MUSD of new orders to 2024, which would be ahead of plan.

Profitability: after the last two years of transforming the business model towards tighter scoping, better risk management and cost control, Seamless sees sustainable EBITDA margins in the span of 30-40% depending on the product mix and the pace of expansion in Latin America, which due to its JV nature will be slightly dilutive on the EBITDA% but accretive to the EBITDA in MUSD.

Financial structure: the company has recently extended its bond financing until the end of 2027 and received 25 MSEK from shareholders in new equity, creating a stable financial platform to finance growth. The fixed interest rate of 9% on the bond will also allow the company to reduce interest cost vs the effective interest rate of ca. 13% that the company has paid in recent quarters.

Cash generation: the above growth and margin discipline, bundled with an increased mix of time and material contracts or projects with smaller invoiceable milestones, as well as the last years reduction of CAPEX from ca 40 MSEK to 25 MSEK per year will help drive improved cash generation. As a result of the improved sales, EBITDA, and lower interest cost the company expects, to create positive operating free cash flows that increase with a CAGR of 20-25% over the coming years - and where the company aims to reduce net debt from a projected year end figure of 209 MSEK down towards 100 MSEK by the end of 2027.

Seamless Distribution Systems (SDS) is a global technology leader in fintech, delivering end-to-end software platforms for electronic transactions and digitalization of the supply chain of Mobile Network Operator's services. SDS consistently delivers process efficiency and operational excellence, with 30+ years of experience and closeness to customers.

At Seamless, innovation is an ongoing process that is part of our inherent culture. We have a superior suite of data-driven solutions that provide transparency, capture, and analyze integrated data and allow our customers to leverage and optimize capabilities.

Seamless aims to enable enterprises to track, process and monetize digital value through modern and user-friendly solutions designed to increase market insight, competitiveness and cost efficiency.

Our global team is spread across 14 offices with highly qualified professionals in the areas of telecom sales and distribution and systems integration. To ensure a localized experience and quick turnaround time, sales and support are in close geographical proximity to the customers.

years of experience in digitization of services

transactions processed every year

countries-wide global footprint

active resellers per month

users served globally

We have grown with our customers into new markets and we plan to expand even further in the future. Since our first deal with the MTN Group in Congo in 2007, SDS has partnered with them in 16 new markets and we’ve multiplied our organic growth with other key accounts as well. Today we partner with the Orange Group across 9 markets, with Ooredoo in 4, with Zain in 3 and with Telenor and Glo in 2 markets each. We also have prominent customers like Du, Vodafone, Safaricom, Unitel and Djezzy with massive future growth potential.

Our intuitive retail value management solution continues to create immense value for customers while enabling them to drive profitable growth and reach unmatched levels of operational efficiency in a market where $8.5 trillion worth of digital transactions* are processed/year.

*Source: https://www.statista.com/outlook/dmo/fintech/digital-payments/worldwide

Our financial technology and digital distribution management business leverages 30+ years of technology and expertise to transform an industry that has a massive value of over $2,800 billion*.

*Source: https://www.thebusinessresearchcompany.com/report/telecom-global-market-report

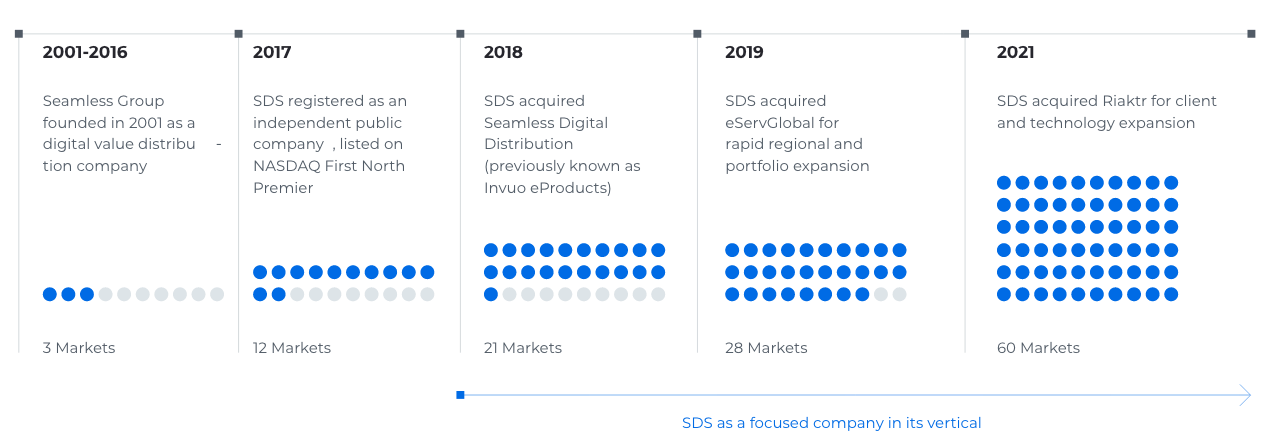

SDS has a clear strategy to not only grow organically with its customers, but also to grow through acquisitions. In recent years, SDS has carried out three acquisitions, all of which have contributed to the group's profitability and technological development.

Since being listed on Nasdaq in 2017, SDS has experienced sales growth of 40% on average per year, and EBITDA and Compounded Annual Growth Rate (CAGR) of 61%. Our strategy is to continue that growth journey and make financial and technological services more accessible and affordable for people in developing regions.

We empower customers with the right tools that fit their novel business needs and conduct a thorough analysis of their pain points, needs, available resources and expectations to create true value through our robust solutions.

We strive to foster a growth mindset and are constantly reinventing ways to improve how our customers create and transfer value across their distribution channels to enable them to consistently obtain profitable growth.

We simplify and prioritize customer experiences to accelerate the shift from traditional to digital in supply and distribution all while optimizing cost structures to continue to hold our position as innovators and thought leaders.

Championing innovation to maintain our standard of excellence

Customer Growth Rate

Sales Growth

EBITDA